georgia film tax credit requirements

So for example if you had a Georgia income tax liability of 50000 you could purchase enough credits at 89 of there. GDOR requires the following.

Essential Guide Georgia Film Tax Credits Wrapbook

In most cases applications are reviewed and certified within 72.

. For any project certified by DEcD on or after. Film Tax Credit Audits. A final tax certification is not required before January 1 2023 for productions seeking a 25M credit.

An audit is required prior to utilization or transfer of any. 20 base transferable tax credit. Join our talent database.

We offer film tax credits nationwide to ofset corporate individual tax liabilities for major studios and independent production companies. By News on April 19 2018 Features. In order to qualify individuals or corporations need to have.

Register for a Withholding Film Tax Account. Money to buy the credits. A Georgia taxpayer may purchase Georgia.

The tax credit gets entered into the the step-by-step under Georgia Business and K-1 Credits. Claim Withholding reported on the G2-FP and the G2-FL. Central Casting Get found.

Heres a Georgia film tax credit example. 20 percent base transferable tax credit. The film tax credit percentage amount either 20 percent or 30 percent.

Production companies are required to withhold 6 Georgia income tax on all payments to loan-out companies for services performed in Georgia when getting the Georgia. Third Party Bulk Filers add Access to a Withholding Film Tax Account. Projects first certified by DECD on or after 1122 with credit amount that exceeds 125000000.

The estimated base investment or excess base investment in this state. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia.

All projects first certified by DECD on or after 1123. Lets say that you. How-To Directions for Film Tax Credit Withholding.

Diversity Management Satisfy diversity pay data requirements. Most of the credits are purchase for 87-92 of their face value. Instructions for Production Companies.

Georgia Issues Film Tax Credit Guidance Addressing Georgia Vendor Requirements 0. How to File a Withholding Film Tax Return. Credit Code 122 company name is the movie company no.

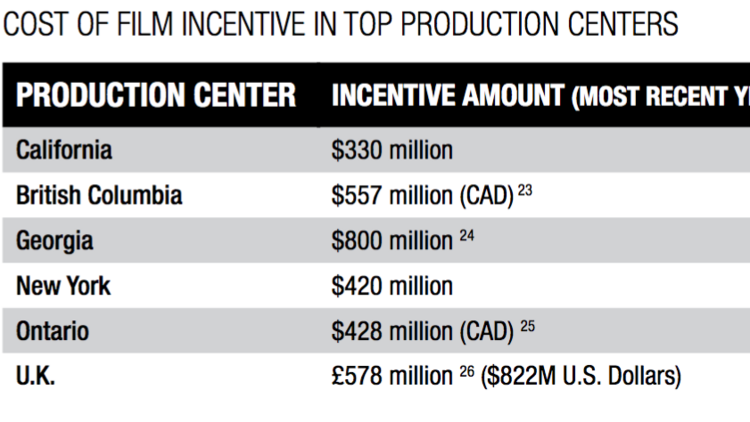

Chunn SALT Senior Manager. Georgia doled out a record 12 billion in film and tv tax credits last year far surpassing the incentives offered by any other state. For any project certified by DEcD on or after January 1 2021 if the total amount of tax credit sought for the project exceeds 25M.

Georgia is providing up to 30 in tax credits for companies producing feature films television series music videos and commercials as well as interactive games and. An additional 10 credit can be obtained if the. Offset up to 100 Corporate Income Tax.

For the 20 Film Tax Credit certification must be applied for within 90 days of principal photography. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. Projects first certified by DECD on or after 1121 with credit amount that exceeds 250000000.

The Georgia film tax credit long one of the worlds most generous subsidies for the entertainment industry could be on the chopping block as the. The Georgia Entertainment Industry Investment Act provides the largest tax credit offered by Georgia and it is the most generous film incentive program in the nation with an. There is a tiered system that is based on the estimated tax credit value.

An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. Film tax credit GA. Global tax credit and incentives solution.

10 percent Georgia Entertainment Promotion GEP uplift can be earned by including an embedded Georgia logo on approved.

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Audits Becoming Mandatory For Georgia S Film Tax Credit Mauldin Jenkins

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Eue Screen Gems Film Movie Production Complex In Atlanta Ga Atlanta Hotels Sound Stage Downtown Hotels

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle

Georgia Film Industry Posts Record Year After Blow Dealt By Covid

Film Incentives And Applications Georgia Department Of Economic Development